nh meals tax calculator

While New Hampshire lacks a sales tax and personal income tax it does have some of the highest property taxes in the country. 8am - 430pm M-F.

6 Steps To Sales Tax Compliance Just In Time For The Holidays Taxjar

On average homeowners in New.

. The Meals and Rentals Tax is a tax imposed at a rate of 9 on taxable meals occupancies and rentals of vehicles. New Hampshire Property Tax. Supplemental Nutrition Assistance Program SNAP.

New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. Home page to the New Hampshire Department of Revenue Administrations website. Last updated November 27 2020.

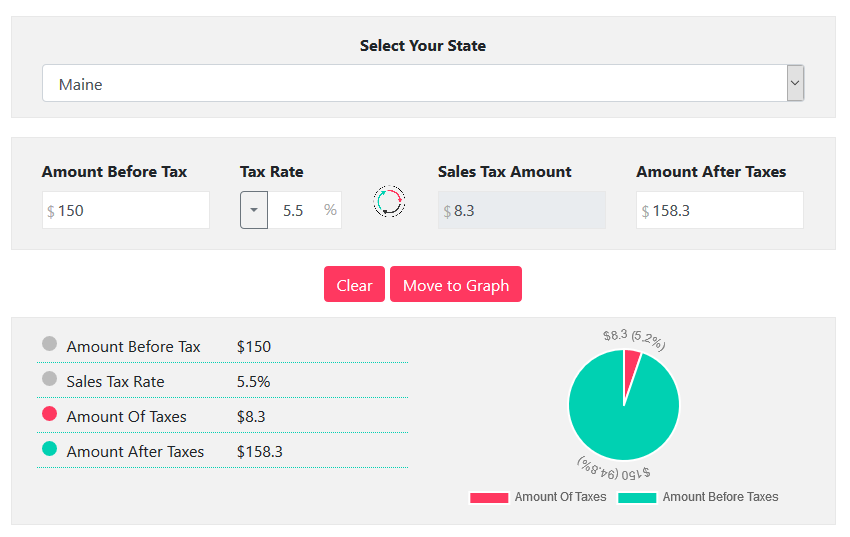

Check e-file status refund tracker. A 9 tax is also assessed on motor vehicle rentals. A calculator to quickly and easily determine the tip sales tax and other details for a bill.

New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. Census Bureau Number of cities that have local income taxes. Meals paid for with food stampscoupons.

Some schools and students. Advance Child Tax Credits ACTC payments are early IRS payments from the 50 percent of the estimated amount of the Child Tax Credit that you may claim on. 603-271-3176 Hours of Operation.

New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. New Hampshire Meals and Rooms Tax Database Author. 1-800-735-2964 fax.

Of such organization shall be subject to tax if the meals are served or furnished at a location where meals are offered to the general public on a regular and continuous basis without regard to an. There is also a 85 tax on car rentals. Rev 70104 Department means the New Hampshire department of revenue administration.

The State of New Hampshire does not issue Meals Rentals Tax exempt certificates. Food. If you have any questions about tax-exempt sales please call the Departments Division of Taxpayer Services for clarification at 603 230-5030.

New Hampshire Department of Revenue Administration Governor Hugh Gallen State Office Park 109 Pleasant Street Medical Surgical Building Concord NH 603 230-5000 TDD Access Relay NH. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. You may be required to file New Hampshire business tax returns if your gross business income exceeds 50000.

The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations. Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. NEW HAMPSHIRE 2016 MEALS RENTALS TAX BOOKLET RSA 78-A - REV 700 This booklet contains the following New Hampshire state.

Multiply this amount by 09 9 and enter the result on Line 2. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for New Hampshire residents only.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any. 622009 93109 AM. 0 5 tax on interest and dividends Median household income.

New Hampshire is one of the few states with no statewide sales tax. Exact tax amount may vary for different items. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

It is not a substitute for the advice of an accountant or other tax professional. You may be required to file New Hampshire business tax returns if your gross business income exceeds 50000. Tax is 500 or greater.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. TIR 2021-004 2021 Legislative Session in Review.

Annual Meals Rooms Tax Distribution Report Revenue to Cities and Towns MR Tax Homepage MR Tax Frequently Asked Questions. Contact Mailing Address. See page 9 for details on Business Profits Tax and Business Enterprise Tax or.

LicenseSuite is the fastest and easiest way to get your New Hampshire meals tax restaurant tax. New Hampshire is one of the few states with no statewide sales tax. 2022 New Hampshire state sales tax.

Van Buren Street Suite 100-321 Chicago IL 60607 Phone. Please see the following New Hampshire Department of Revenue Administration document for more details on the nature of the tax itself. Designed for mobile and desktop clients.

NHDRA explains how to calculate property taxes as it releases new town tax rates. October 25 2021. There have been important changes to the Child Tax Credit that will help many families receive advance payments.

There are however several specific taxes levied on particular services or products. This includes hotel and room taxes fees other surcharges as well as New Hampshires 9 Meals and Rooms tax. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Hotels seasonal home rentals campsites restaurants and vehicle rental agencies are required to register with and obtain a license from the Department of. Ss by 2504 eff 10. New Hampshire Department of Labor 95 Pleasant Street Concord NH 03301 Telephone.

Meals Rooms and Rentals Tax RSA 78-A. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. New Hampshire Paycheck Quick Facts.

Nh meals tax calculator. New Hampshire income tax rate. Use this app to split bills when dining with friends or to verify costs of an individual purchase.

The tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85. If you need any assistance please contact us at 1-800-870-0285.

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Sales Tax Rate 2022

Nh Food Tax Calculator Iae News Site

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Wisconsin Sales Tax Small Business Guide Truic

Nh Food Tax Calculator Iae News Site

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

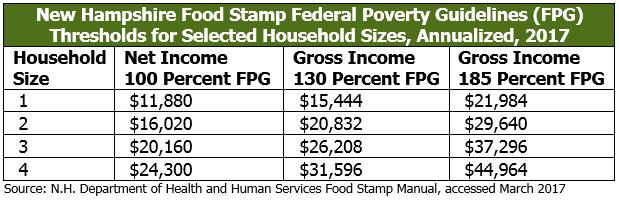

The New Hampshire Food Stamp Program New Hampshire Fiscal Policy Institute

New Hampshire Income Tax Calculator Smartasset

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Nh Food Tax Calculator Iae News Site

New Hampshire Income Tax Nh State Tax Calculator Community Tax

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

New Hampshire Sales Tax Rate 2022